defer capital gains tax uk

Income tax relief 30. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0.

Deferring Capital Gains Tax On Uk Property Disposals

There is a lower rate of 6150 for most trustees.

. Here are some ways to potentially reduce your capital gains tax liability. Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. These rules aim to prevent people from leaving the UK to dispose of an asset just to avoid capital gains tax.

Investors relief is a capital gains tax CGT relief on the disposal of qualifying shares in an unlisted company. Capital gains tax UK property disposals return. 1 Use your CGT exemption.

Under the Tax Cuts Jobs Act which took effect in. Traditionally you would sell your asset and then have to pay the IRS 20-35 in capital gains tax. Capital gains tax EIS deferral relief.

If you are temporarily non-resident then in the year of your return to the UK any gains or losses realised during your period of non-residence including in an overseas part of a split year become chargeable to capital gains tax in the year of return. The deferred sales trust is a tax deferral strategy that can help owners avoid paying capital gains. You shouldnt pay twice.

This provides a ready supply of venture capital to growing businesses. The annual exempt amount for the 2020-21 tax year is 12300. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether.

The latter rate applies where the individual is subject to income tax at the higher rate of income tax. To help reduce CGT payable on small gains you could consider crystallising the gains over two separate tax years. Antiques by individuals at two rates namely 18 andor 28.

100000 Capital Gain Invested via EIS. The revaluation gain is 2M which will be recorded as other comprehensive income OCI so the deferred tax liability on this gain 2M x 20 04M is also recorded under OCI. The 1012 Tax Bracket.

You must give details of the disposal on the Capital Gains Tax summary pages of your tax return if either. Deferring Capital Gains Tax on UK property disposals. IRS allows you to avoid paying capital gains tax if any of your principal is withdrawn.

Deferral relief allows a UK resident investor to defer capital gains tax. Capital gains tax rates. Roll-over relief lets you put off paying any capital gains tax CGT due on the gain from the sale of a business asset until you sell the business asset that you bought to replace it.

Everyone has an annual capital gains tax allowance or annual exempt amount in HMRC-speak. If your total taxable gains minus any deductions comes to more than your annual allowance then you pay CGT on everything over that tax-free allowance. HM Revenue Customs.

Debit deferred tax expense 05M. Some countries such as Spain have a form of deferral relief where a main residence is sold and the proceeds are reinvested in more qualifying property. How Do I Pay Less Capital Gains Tax Uk.

Credit Deferred tax liability 05M. Gains and losses realised in the same tax year must be offset against each other which can reduce the amount of gain that is subject to tax. To avoid a CGT charge on an otherwise taxable disposal requires an absence from.

This measure deals with the deferment of payment of Capital Gains Tax by certain UK resident trusts or non-UK resident individuals who trade through a UK branch. 2 Make use of losses. Capital gains refers to the overall profit you made on your asset.

Tax relief for reinvestment of gains in qualifying schemes is intended to stimulate investment in small businesses and is incorporated into the enterprise investment scheme EIS as EIS deferral relief. An individuals net taxable income and chargeable gains for the tax year influence the rate of tax payable on their capital gains. Can I Defer Paying Capital Gains Tax.

Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20 or 28 in tax years where their taxable income and gains exceed the basic rate threshold 37700 for the 202122 and 202223 tax years but only 10 or 18 on gains in years where their net. Increase the deferred tax liability by 05M. In general investors can potentially benefit both from the deferral of gains which can be reinvested under EIS and from ER on those same deferred gains when they come back into charge.

Firstly its important to note that there is no general provision allowing CGT on a residential property to be avoided by simply reinvesting the proceeds. A taxpayer making a disposal that qualifies for investors relief will pay tax at a rate of 10Although it is a separate relief. 30000 Capital Gains Deferral CGT 20 20000 Net Cost to Investor.

If you made a 2 million dollar profit over one-fifth of that would be paid out to the IRS because of capital gains taxes. You might be able to minimise your CGT liability by using losses to reduce your gain. Depending on the amount of capital gains realized from the sale of your business or property to the deferred sales trust you can defer your tax indefinitely by keeping the principle amount invested in that investment.

The total value of the EIS shares and any other assets you disposed of in the tax year. Many countries including the US the UK Canada and Australia assess capital gains taxes on any profit you make from the sale of a home. Instead of taxing it at your regular income tax rate they tax it at the lower long-term capital gains tax rate 15 for most Americans.

Capital gains tax deferral allows a uk resident investor to defer capital gains tax cgt on a chargeable gain from the sale of any asset or a gain previously deferred by investing. See the Introduction to capital gains tax guidance note. There is also 30 Income Tax relief on the investment.

This allowance is 12300 as of 6 April 2022. The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain. You can use it or you can lose it your allowance is 12300 so that you will not be able to carry it back into the future Make any gains offset against losses Investing in an all-in-one fund is an option Manage your taxable income.

You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. In overview ER provides a lower capital gains tax rate of 10 as compared to a standard rate of 20 on gains arising when disposing of qualifying assets. If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given.

Everyone is allowed to make a certain amount of tax-free capital gains each year.

Deferred Tax Asset Liability How To Calculate In Income Tax

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form

How To Defer Capital Gains Tax Or Avoid It Altogether Wealth And Tax Management

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

.png)

What Is Cgt Deferral Relief Rlc Ventures

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

Deferred Tax Double Entry Bookkeeping

Deferred Tax Asset Liability How To Calculate In Income Tax

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

Multifamily Investors Here S Why Cost Segregation Is Your Friend Capital Gains Tax Property Investor Real Estate Investing

New Uk Gaap Deferred Tax Aat Comment

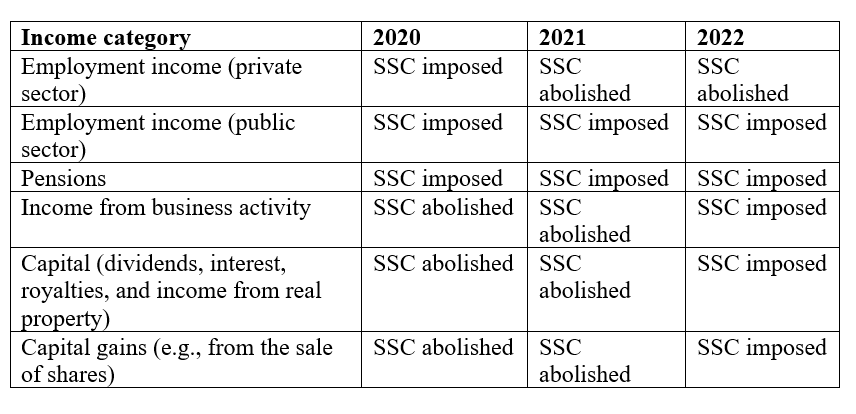

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

We Advise Taxpayers On Tax Efficient Structuring Of Cross Border Investments Including Optimum Use Of Tax Treaties Foreign Tax Investing Tax Credits Secrecy

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)